Investing in Critical Industries

Companies

AEyeSoftware defined high-resolution LiDAR

Current Stage

IPOPartnered In

2017Airy3D3D technology giving machines the full power and intelligence of sight

Current Stage

EarlyPartnered In

2017AmyrisClean, effective ingredients for everyday use

Current Stage

IPOPartnered In

2008Bedrock50x higher resolution maps of the seafloor

Current Stage

EarlyPartnered In

2021BloomSolid oxide fuel cells that produce electricity on-site

Current Stage

IPOPartnered In

2006CascadeCatalyzing green chemistry with the power of biology

Current Stage

EarlyPartnered In

2023Drift NetAI enabled security and detection system for school safety

Current Stage

EarlyPartnered In

2023FoxtrotIYKYK

Current Stage

GrowthPartnered In

2021HedgehogBuilds robotic farms that grows protein-rich foods with near-zero environmental impact.

Current Stage

EarlyPartnered In

2023InevitableSupercharging farm productivity with AI

Current Stage

EarlyPartnered In

2019Light Field LabAdvanced displays that are beyond holograms

Current Stage

EarlyPartnered In

2017More LabsScience-backed supplements

Current Stage

GrowthPartnered In

2018OculiiHD radar that provides a 100x increase in spatial resolution

Current Stage

AcquiredPartnered In

2021OverflowFintech platform for all philanthropic giving across every major asset class

Current Stage

EarlyPartnered In

2021PivotAdvanced breathalyzer that helps people quit smoking

Current Stage

EarlyPartnered In

2017RamperSimple login for blockchain applications

Current Stage

EarlyPartnered In

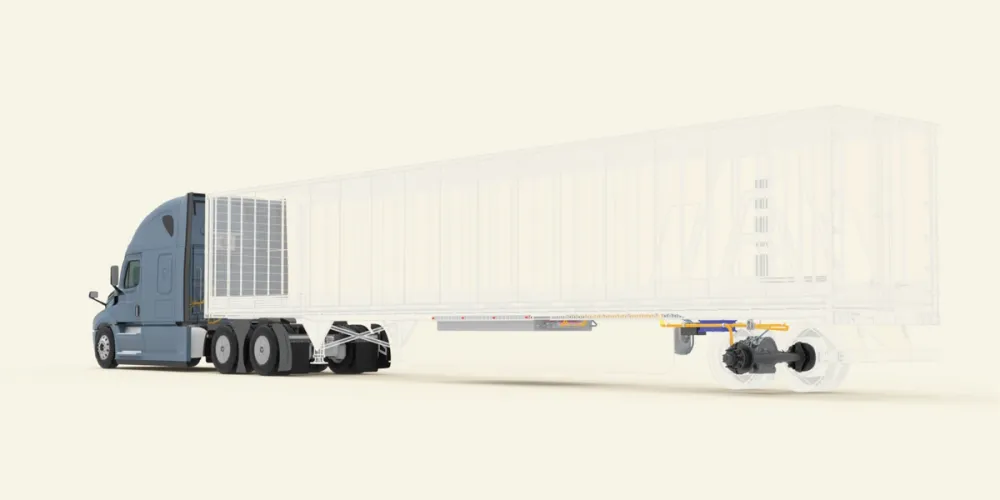

2022Range EnergyIntelligent, electric trailers

Current Stage

EarlyPartnered In

2021ReshapeBuilding the next generation of lab automation robots

Current Stage

EarlyPartnered In

2023Roam RoboticsIncreasing human strength with exoskeletons

Current Stage

EarlyPartnered In

2018XwingAutonomous cargo flights without the pilot

Current Stage

GrowthPartnered In

2019